Welcome to the UK! This guide will explain how to build a credit score UK from scratch in 5 simple, easy to follow steps. Building a good financial reputation is a vital part of your UK settlement roadmap if you plan to stay here long term.

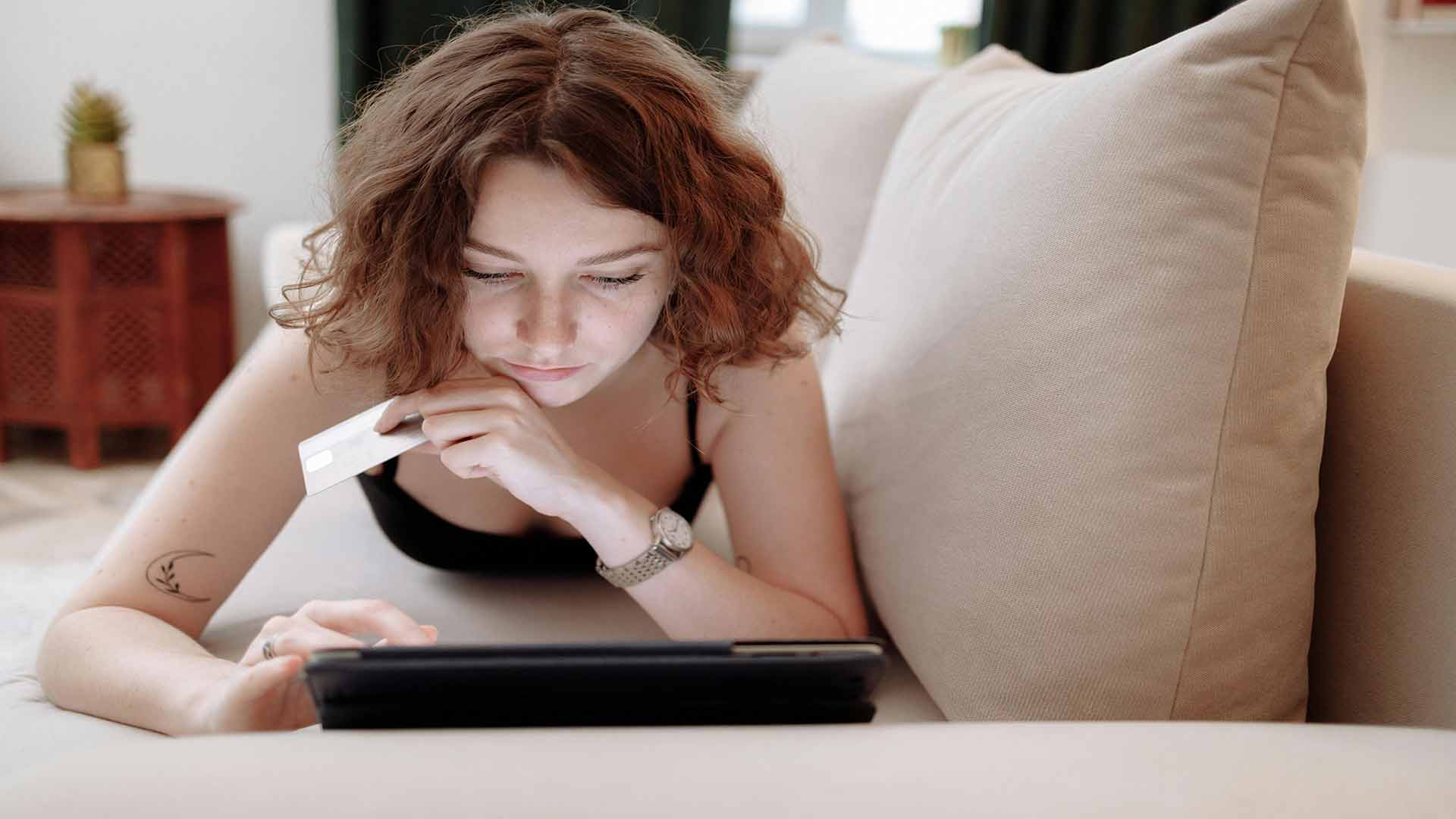

When you are new to a country, you might hear about something called a “credit score.” It can seem confusing, but it is very important. A good credit score helps you do things like get a mobile phone contract, borrow money, or even get a mortgage for a house in the future. But what if you have no credit history here?

What is a UK Credit Score?

A UK credit score is a number that shows how reliable you are at borrowing and repaying money. Banks and other companies use this number to decide if they should lend you money or give you a service. A higher score is better.

When you are a newcomer, your credit history from your home country does not usually transfer to the UK. This means you are starting from zero. But don’t worry, everyone starts somewhere!

Step 1: Get on the Electoral Roll

“Understanding how to build credit score UK from scratch is essential for accessing better financial products. To get started, registering to vote is one of the easiest and fastest ways to prove your identity and address to credit reference agencies.”

- Who can register? Citizens of the UK, Ireland, the EU, or the Commonwealth living in the UK can register.

- How to do it: You can register online on the GOV.UK website. It only takes about 5 minutes.

- Why it helps: It confirms your name and address, which makes your credit profile look more stable and trustworthy

Step 2: Open a UK Bank Account

Having a UK current account and using it responsibly is a key part of building your credit history.

- Why it helps: It shows that you have a stable financial relationship with a UK bank.

- What to do: If you haven’t already, open a UK bank account. Make sure your salary is paid into this account and you use it to pay your bills.

Step 3: Pay Your Bills on Time, Every Time

This is the most important rule. Your payment history has the biggest impact on your credit score.

Bills that help build your credit score include:

- Household utility bills (gas, electricity, water) in your name.

- Council Tax payments.

- Mobile phone contracts.

- Broadband (internet) contracts.

Always pay these bills by the due date. The easiest way to do this is by setting up a “Direct Debit,” which is an automatic payment from your bank account.

Did you know?

In the UK, if your utility bills aren’t registered in your name, they might not help your credit score at all even if you pay them on time. Credit reference agencies only consider accounts officially linked to you, so renters whose landlords handle the bills could miss out on valuable credit-building opportunities.

Step 4: Consider a Credit Builder Credit Card

After a few months, you might be able to get a special type of credit card called a “credit-builder card.” These cards are designed for people with little or no credit history.

- How it works: You use the card for small, regular purchases (like your weekly groceries or a coffee).

- The Golden Rule: You must pay the full balance back every single month. Never spend more than you can afford to repay.

- Why it helps: By using the card and paying it back on time, you show lenders that you are a responsible borrower. This will significantly boost your score over time.

Step 5: Check Your Credit Report Regularly

You should check your credit report to see your progress and make sure there are no mistakes. In the UK, there are three main credit reference agencies. You can check your score for free with each of them.

Checking your report does not harm your score. It helps you understand what is helping or hurting your score, so you can stay on the right track.

Conclusion

Knowing how to build credit score UK from scratch is an essential skill for any newcomer. It takes time and patience, so don’t expect a high score overnight. By getting on the electoral roll, paying all your bills on time, and using a little credit responsibly, you will build a strong credit history. This will open up many financial opportunities for your future in the UK.

Not sure about something?

Ask your question in the comments! I check them regularly and answer so others benefit as well. For private inquiries, you can always use my Contact page.

Hi sam

I just moved to London and want to build my credit score from zero.

I read point 3 about paying utility bills, but I’m renting and my landlord pays the electricity and gas bills.

How can I put these bills in my name without causing any problems?

Do I need to make new contracts with the utility companies?

Waiting for your answer. it’s really helpful! 😊

Hi Artem, Welcome my friend.

and about your question: Yes, many tenants have this question. Here’s the easy solution:

Contact the energy and water companies (British Gas, Thames Water, etc.)

Ask to put the bills in your name or make a joint account. it’s quick and free.

Of course, you must first talk to your landlord and agree with him.

If you can’t agree, a broadband contract (internet) in your name is also very helpful.

The important thing is to have one regular monthly payment that you pay on time every month for several months without any delay or break. That builds your score fast!

Also don’t forget: register on the Electoral Roll (gov.uk) . it’s free and the quickest start.

Good luck